Understanding MEV

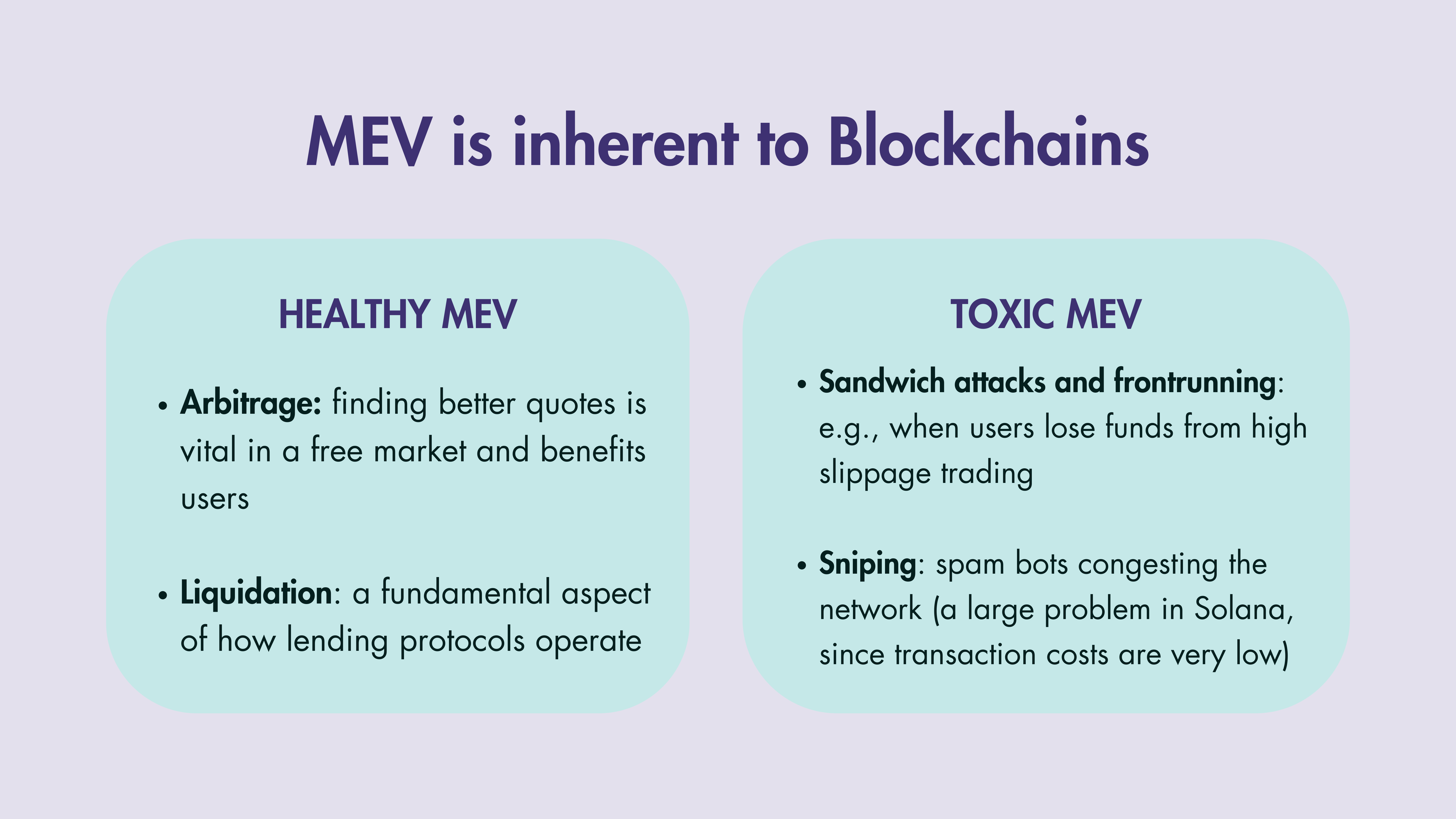

MEV refers to the "Maximum Extractable Value", an economic phenomenon representing profit opportunities arising from on-chain transactions.

For example, a large swap on a DEX can cause token prices in a pool to fluctuate. Traders might explore the price difference in another pool to generate a positive surplus, and such arbitrage opportunities are considered MEV.

In general, arbitrage is an example of healthy MEV, as finding better quotes is vital in a free market and benefits the end user.

On the other hand, toxic-MEV can be harmful. For example, when users trade with high slippage and/or are unaware of sandwich attacks or when the network is congested due to heavy sniping.

Urani's Approach

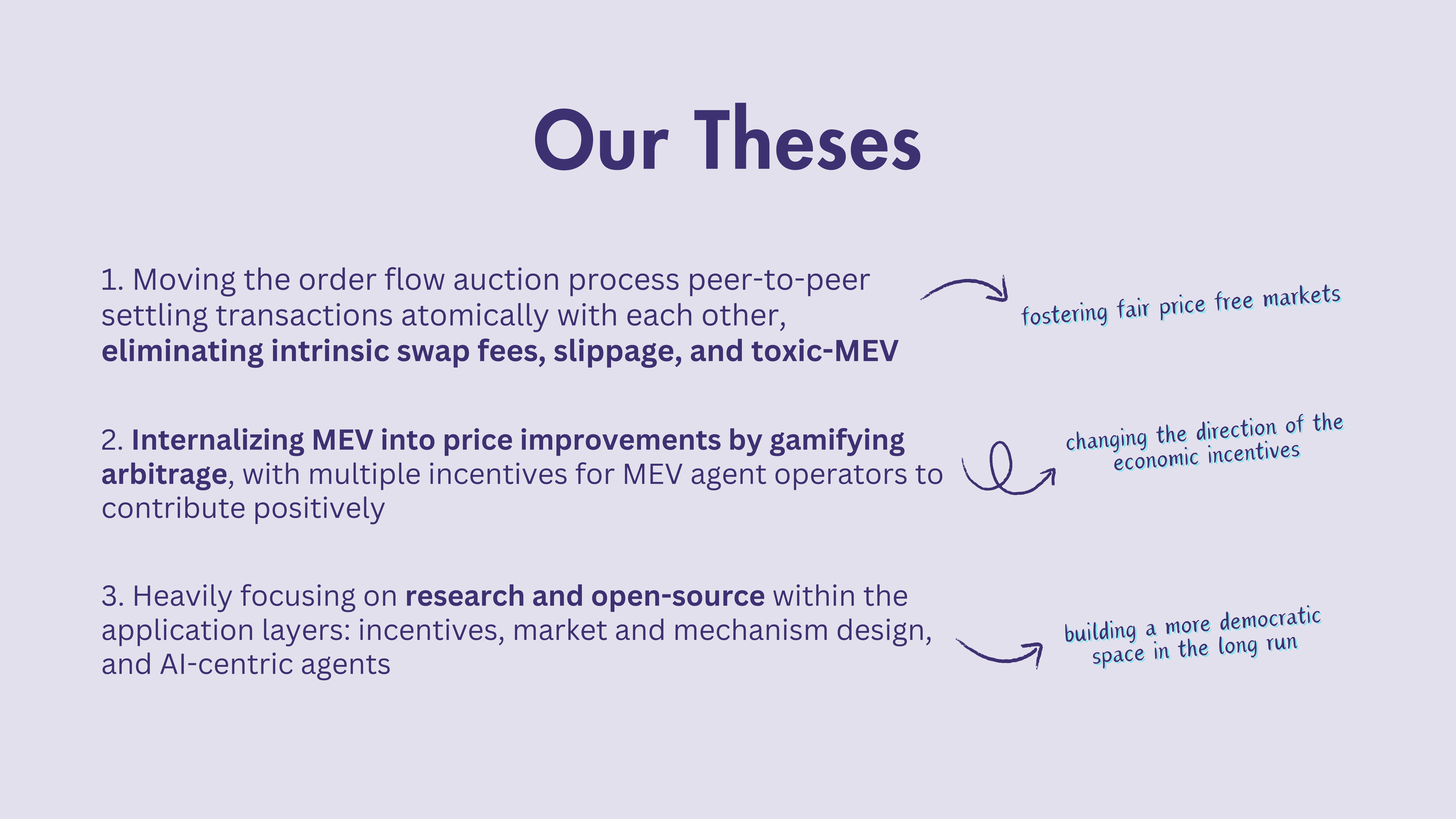

Urani addresses toxic-MEV minimization at the application layer by:

Additionally, we coined the term "MEV agents" to distinguish "healthy" bots from toxic-MEV bots. We refer to the humans behind these bots as "MEV agent operators". At Urani, they are as important as any other actor in the supply chain.

Learn more about MEV

➡️ More information on how Urani helps minimize toxic-MEV is available in our docs.

➡️ Visualize sandwich attacks on Solana with sandwiched.me and on Ethereum with Eigenphi.

➡️ To explore MEV and fee markets on Solana, check out our curated library.

➡️ To delve deeper into MEV in general, explore the Autistic Symposium's toolkit